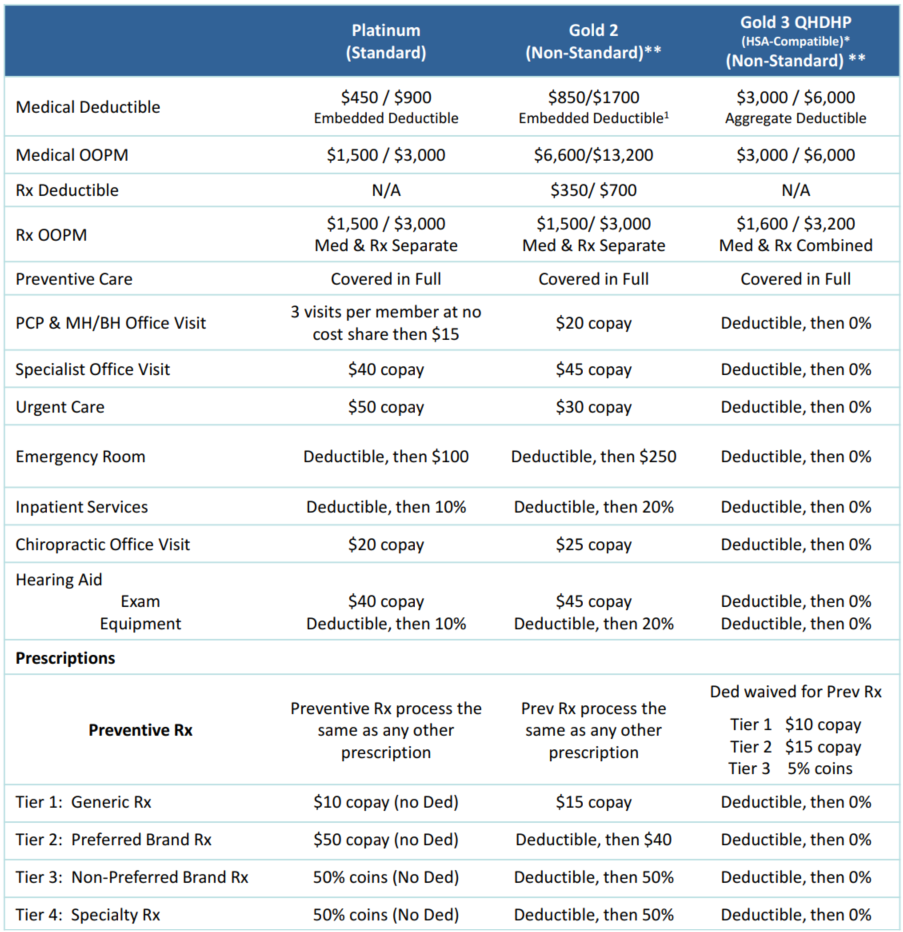

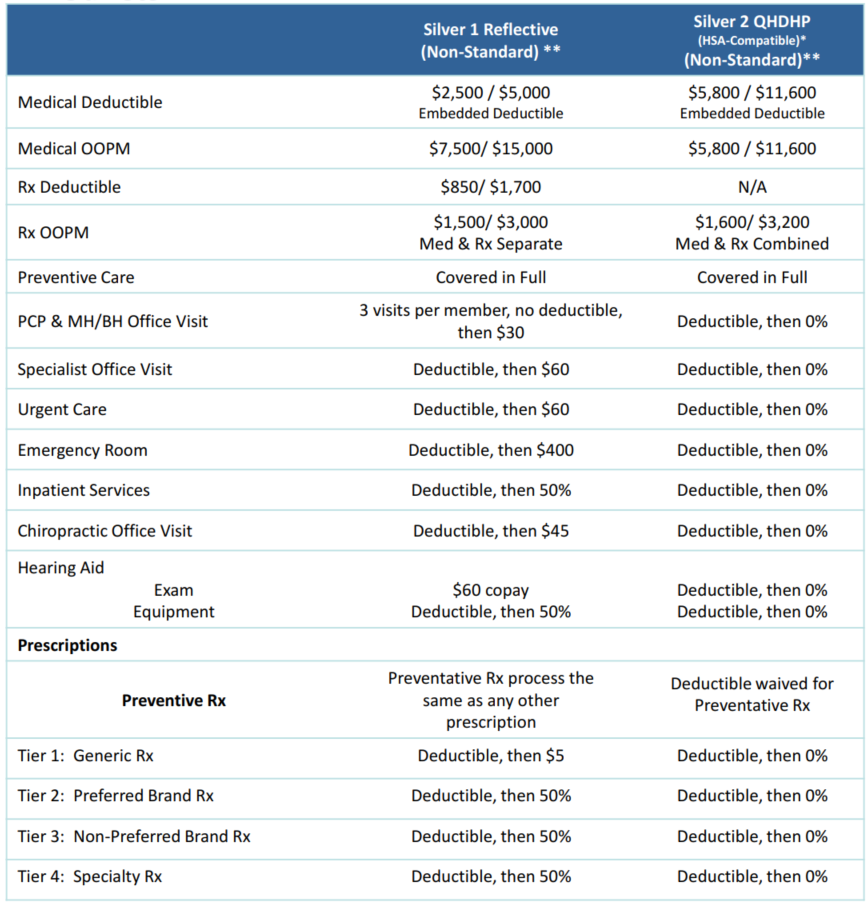

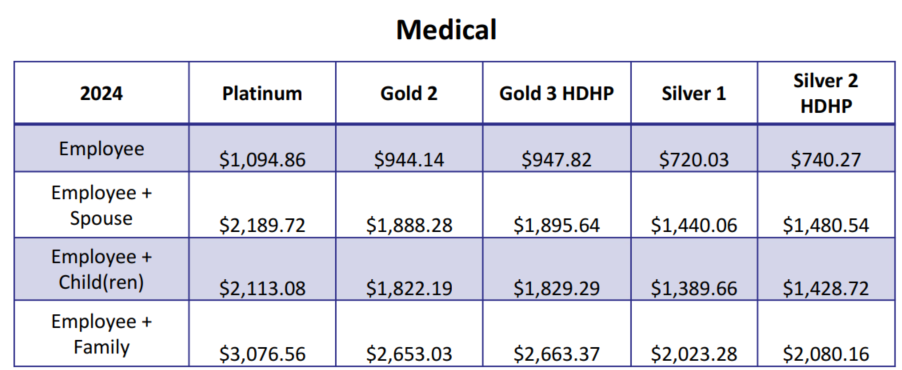

Your Medical Benefits

Upper Valley Haven offers five (5) medical plan to its eligible employees. Coverage is provided through MVP Health Care. Below is information on the benefits.

Contributions

- For full-time (30+ hours) employee: $10,800 an average of $900 per month

- For part-time (20-29 hours) employee: $5,400 an average of $450 per month

Eligibility

1st of the month following date of hire for all full-time and part-time employees working regular hours

Health Savings Accounts (HSA)

An HSA is a tax-free savings account you can use to pay for qualified medical, dental, and vision services. The funds you contribute to an HSA are tax-free, any interest your HSA earns is tax-free, and you won’t pay taxes on funds you withdraw from your HSA to pay for qualified expenses.

Only enrollees in a high deductible health plan (HDHP) who also meet other HSA eligibility requirements may enroll in an HSA.

For more information: How to Save with an HSA

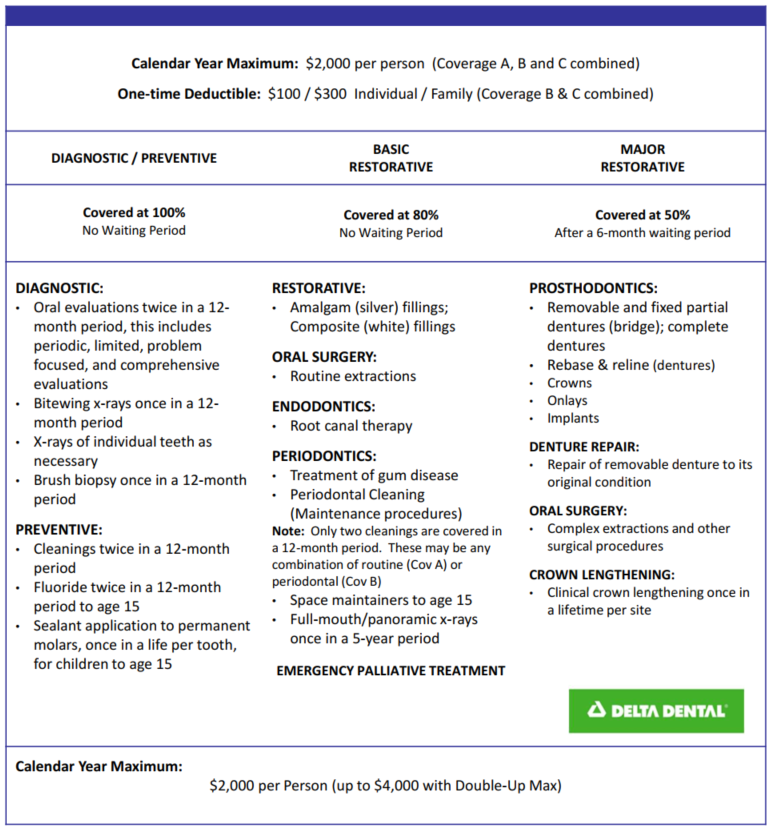

Your Dental Benefits

HOW Program Information

Learn how to get the most out of your Delta Dental plan

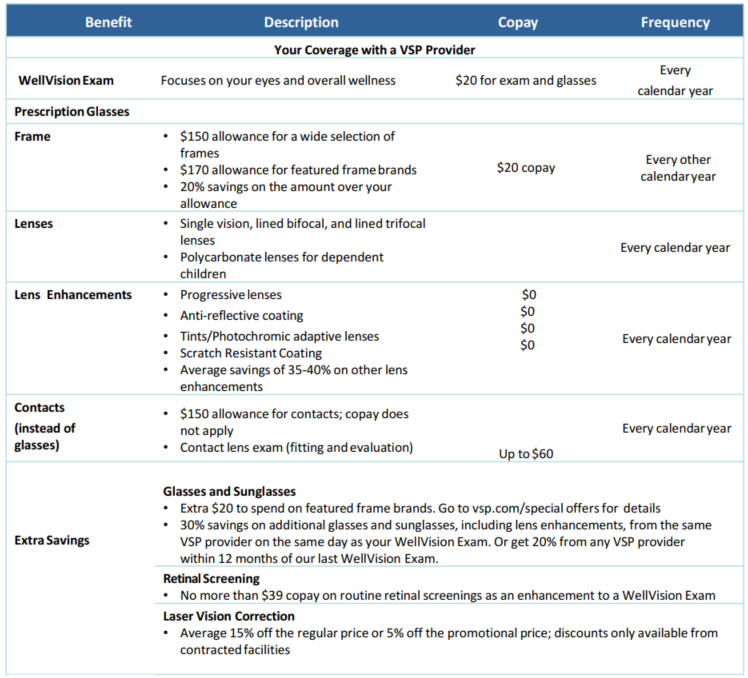

Your Vision Benefits

Upper Valley Haven offers their employees one(1) vision plan. For more information review the Benefit Summary below.

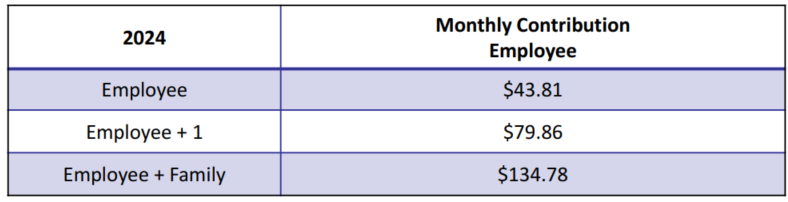

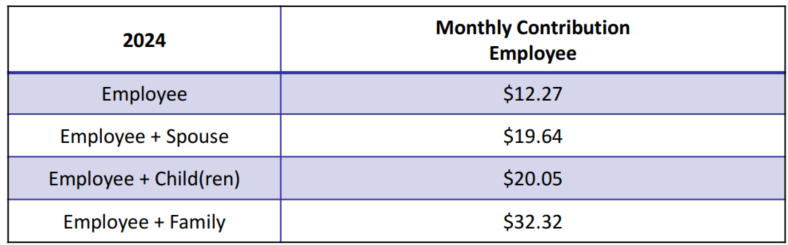

Premiums

These rates reflect full premiums with no defined contribution taken into account.

Eligibility

1st of the month following date of hire for all full-time and part-time employees working regular hours

Your Group Life Benefits

Upper Valley Haven offers Basic Life and Accidental Death & Dismemberment (AD&D) insurance to all eligible employees.

- You are automatically enrolled for $25,000

- Coverage will be reduced by 35% at age 65 and 50% at age 70.

- AD&D: You are automatically enrolled for an amount equal to your Basic Term Life coverage amount.

Contributions

This is 100% Employer paid.

Eligibility

Employees working 24+ hours are 90 days

Your Voluntary Short-Term Disability Benefits

Eligible employees may enroll in Voluntary Short-Term Disability Insurance

- Each employee may elect an amount of insurance in increments of $25 from a minimum of $100 per week to a maximum of $1,500 per week, not to exceed 60% of covered earnings

- There is a 30-day sickness/injury elimination period

Contributions

This is 100% Employee paid.

Eligibility

Employees working 24+ hours after 90 days

Your Employee Assistance Program

The Employee Assistance Program by Magellan Healthcare provides professional and confidential services to help employees and family members address a variety of personal, family, life and work-related issues. From the stress of everyday life to relationship issues or even work-related concerns, the EAP can help with any issue affecting overall health, well-being and life management.

Contributions

This is 100% Employer paid.

Eligibility

All employees are eligible starting on the first day of employment.

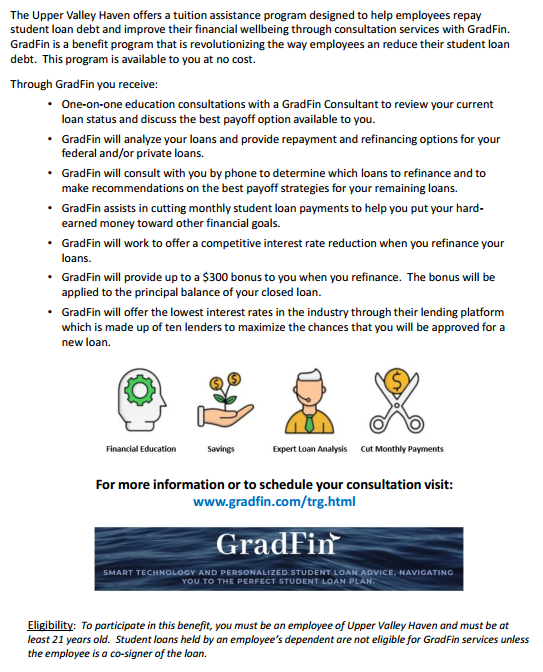

Your Tuition Assistance

EXCITING NEW BENEFIT FOR EMPLOYEES!

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

Minimum age requirement: In order to participate in the plan, you must be at age 21

Help Center

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Plan Information

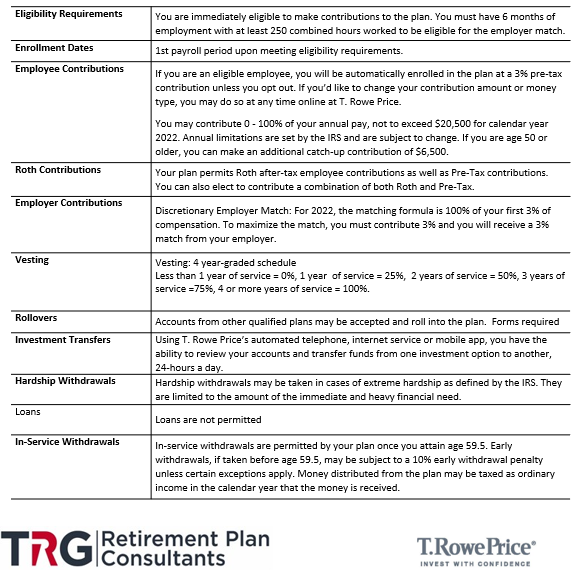

Your Retirement Benefits

Upper Valley Haven, Inc. offers employees a 403(b) plan through T. Rowe Price. T. Rowe Price offers a wide selection of investment options and excellent online technology to help you better your retirement plan. Basic plan details are listed below and outlined in more detail in the Summary Plan Description. If you have questions about the plan, contact our Investment Advisor, Steve Burnett from The Richards Group, at sburnett@therichardsgrp.com. You can also call T. Rowe Price at (800) 354-2351 or access your account online at http://rps.troweprice.com.

If you have questions, contact a T. Rowe Price representative:

1-800-354-2351

TTY access, call 1-800-521-0325

Or

Steven Burnett Investment Advisor from The Richards Group:

sburnett@therichardsgrp.com

403(b) Education Session

Upper Valley Haven Vanguard 403(b) Exchange/Transfer Forms

Rollover Forms

Enrollment Flyer

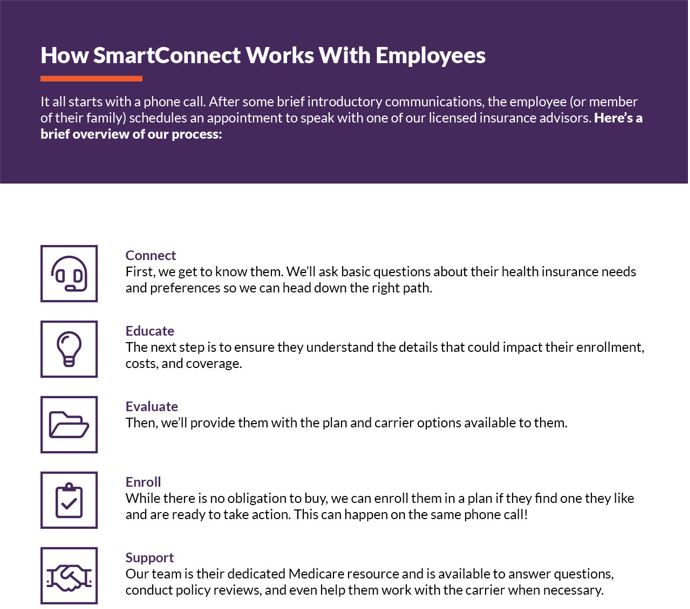

SmartConnect - A Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Upcoming Events

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartmatch.com/

Additional Information