2025 Benefits at a Glance

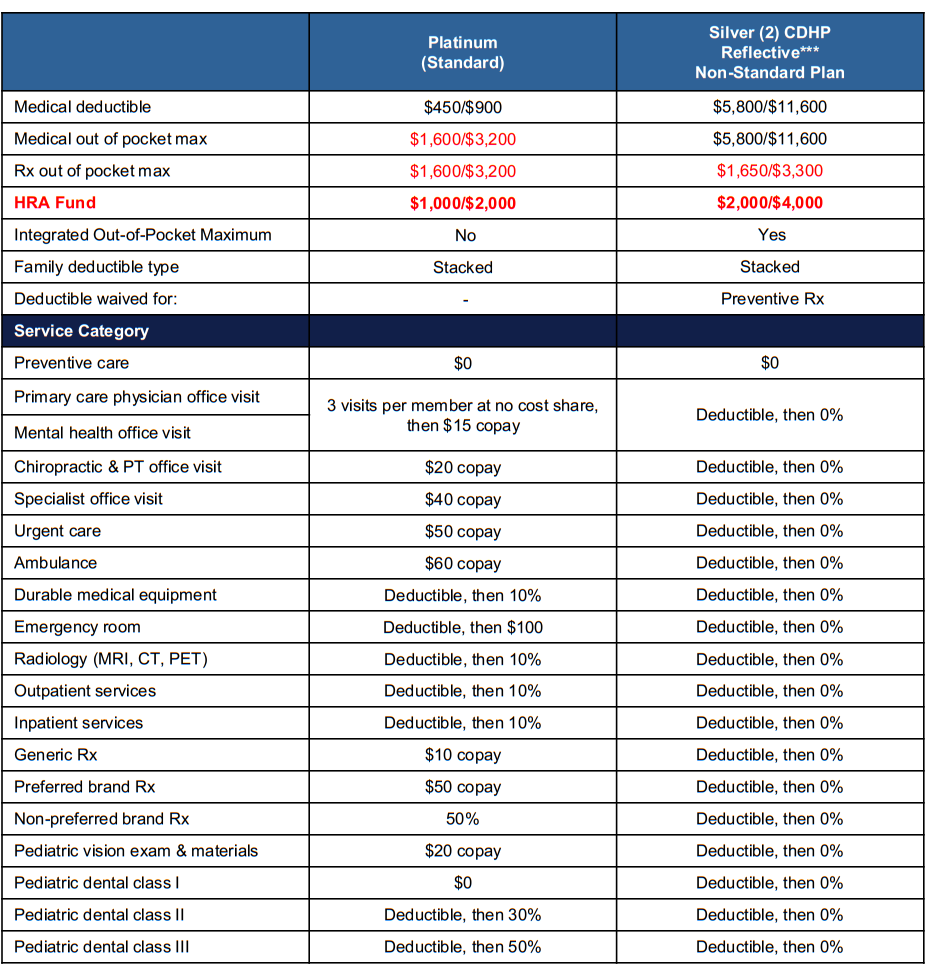

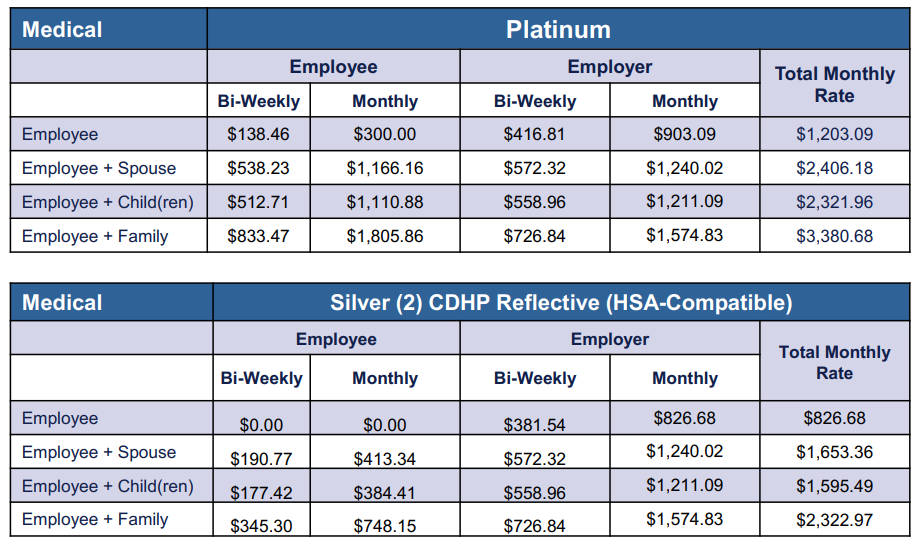

Your Medical Benefits

Upper Valley Haven offers two (2) medical plans to eligible employees. Coverage is provided through MVP Health Care.

Contributions

Eligibility

All full-time and part-time employees who work at twenty (20) hours per week are eligible for coverage the first of the month following 1 month of continuous employment.

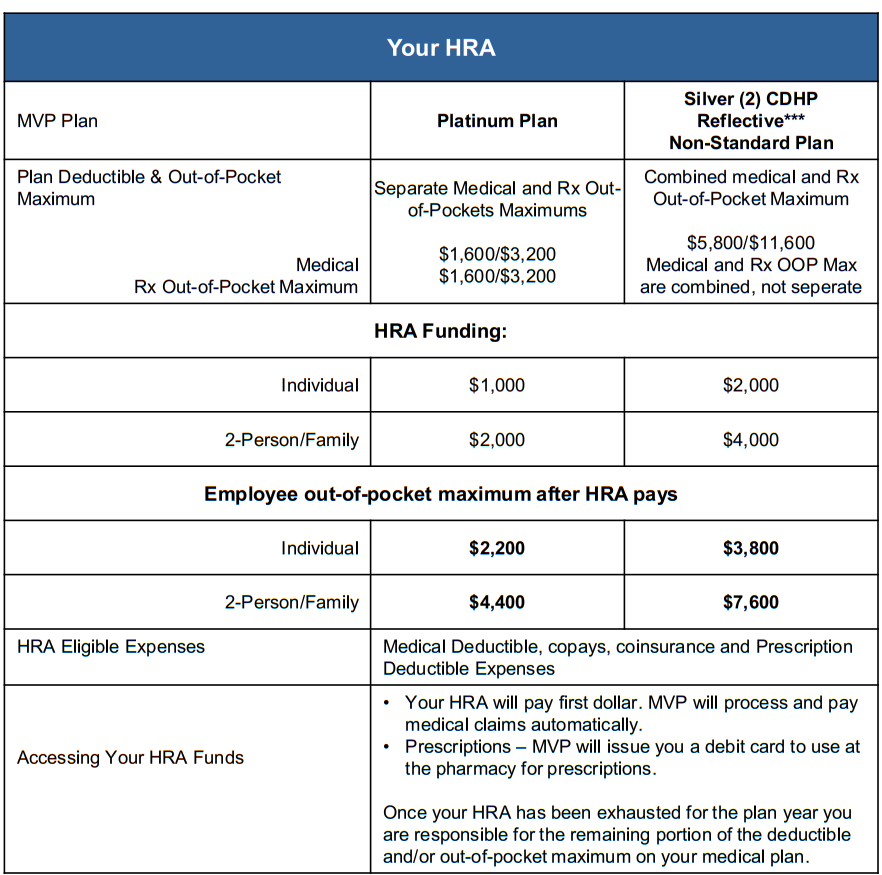

Your Health Reimbursement Account Benefits

What is an HRA?

An HRA is an employer-sponsored plan that can be used to reimburse a portion of you and your eligible family member’s out-of-pocket medical expenses. For your plan, the HRA can be used to offset some of your medical plan deductible responsibilities. The HRA is a financial reimbursement plan funded entirely by your employer. MVP Health Care is the HRA Administrator. They will pay medical claims directly to providers and issue a debit card for your prescriptions.

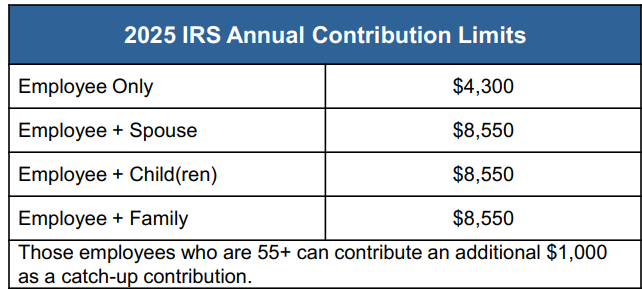

Your HSA Benefits

A Health Savings Account (HSA) is a tax advantaged savings account that you own and control. HSAs are like retirement accounts in that they rollover year-to-year, they are portable when you move jobs or retire, the balance can be invested in mutual funds, and there are survivor benefits.

What Is A Qualified Health Care Expense?

You can use money in your HSA to pay for any qualified health care expenses for you, your spouse and your tax dependents, even if they are not covered on your qualified medical plan. Examples of qualified expenses include: your insurance plan deductibles, copayments, and coinsurance; doctor’s office visits; prescriptions; dental treatments and x-rays; eyeglasses, contacts and vision exams.

Your HSA Store Benefits

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

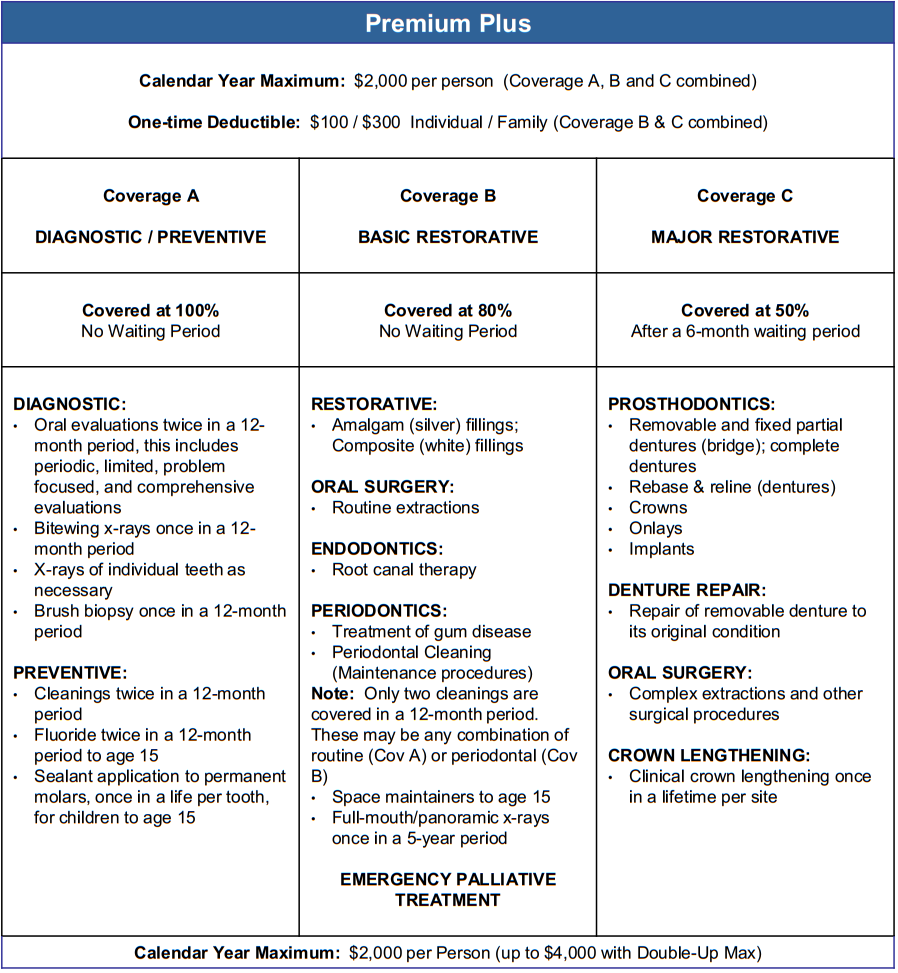

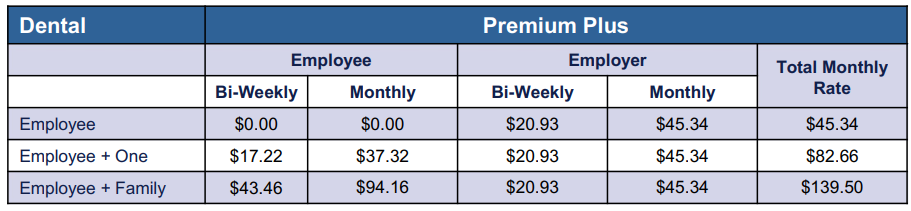

Your Dental Benefits

HOW Program Information

Learn how to get the most out of your Delta Dental plan

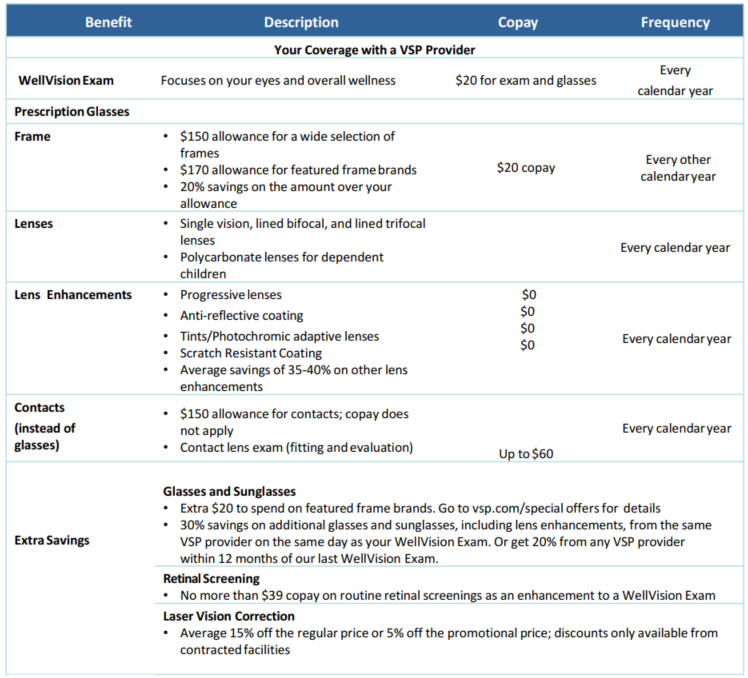

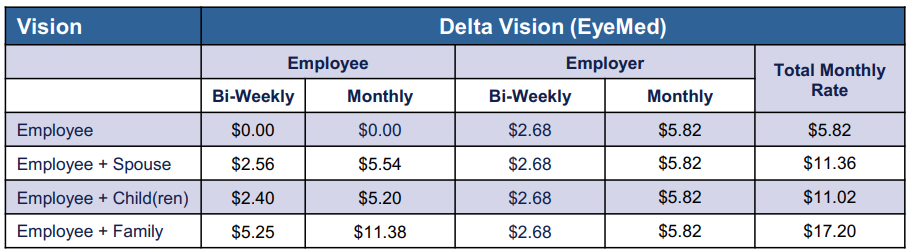

Your Vision Benefits

Upper Valley Haven offers their employees one(1) vision plan. For more information review the Benefit Summary below.

Contributions

Eligibility

All full-time and part-time employees who work at twenty (20) hours per week are eligible for coverage the first of the month following 1 month of continuous employment.

Your Life and AD&D Benefits

Upper Valley Haven offers Basic Life and Accidental Death & Dismemberment (AD&D) insurance to all eligible employees.

- You are automatically enrolled for $25,000

- Coverage will be reduced by 35% at age 65 and 50% at age 70.

- AD&D: You are automatically enrolled for an amount equal to your Basic Term Life coverage amount.

Contributions

This is 100% Employer paid.

Eligibility

All employees who work twenty-four (24) hours per week are eligible for coverage the first of the month following 90 days of continuous employment.

Your Long-Term Disability Benefits

Upper Valley Haven offers Long-Term Disability insurance to all eligible employees.

- Benefit is 60% of monthly earnings up to a maximum of $6,000 per month

- Minimum monthly benefit is $50

- Maximum benefit period to age 65 or SSNRA

- Benefits begin after 180 days of total disability

Contributions

This is 100% Employer paid.

Eligibility

All employees who work twenty-four (24) hours per week are eligible for coverage the first of the month following 90 days of continuous employment.

Your Voluntary Short-Term Disability Benefits

Eligible employees may enroll in Voluntary Short-Term Disability Insurance

- Each employee may elect an amount of insurance in increments of $25 from a minimum of $100 per week to a maximum of $1,500 per week, not to exceed 60% of covered earnings

- There is a 30-day sickness/injury elimination period

Contributions

This is 100% Employee paid.

Eligibility

All employees who work twenty-four (24) hours per week are eligible for coverage the first of the month following 90 days of continuous employment.

Your Employee Assistance Program

The Employee Assistance Program by Magellan Healthcare provides professional and confidential services to help employees and family members address a variety of personal, family, life and work-related issues. From the stress of everyday life to relationship issues or even work-related concerns, the EAP can help with any issue affecting overall health, well-being and life management.

Contributions

This is 100% Employer paid.

Eligibility

All employees are eligible starting on the first day of employment.

Your Tuition Assistance

Upper Valley Haven’s tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility

In order to participate in the plan, you must be at age 21

Contact Information

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Plan Information

Your Retirement Benefits

All employees are eligible to participate in the Upper Valley Haven 403(b) retirement plan through T. Rowe Price. To contribute to your plan, you will be asked to complete a salary deferral agreement to indicate how much of your income you wish to defer to your plan. Contributions will be deducted from your paycheck on a pre-tax basis and/or on an after-tax basis as Roth salary deferrals.

For those making salary deferrals, the Haven will contribute up to 3% of total wages based on your salary deferral. To be eligible to participate in the Haven’s matching contribution portion of the plan, you must have completed a minimum of 6 months of service with 83.3 hours of service in each month.

Contact Information

If you have questions, contact a T. Rowe Price representative: 1-800-354-2351

TTY access, call 1-800-521-0325 or Steven Burnett Investment Advisor from The Richards Group:

sburnett@therichardsgrp.com

Upper Valley Haven Vanguard 403(b) Exchange/Transfer Forms

Rollover Forms

Enrollment Flyer

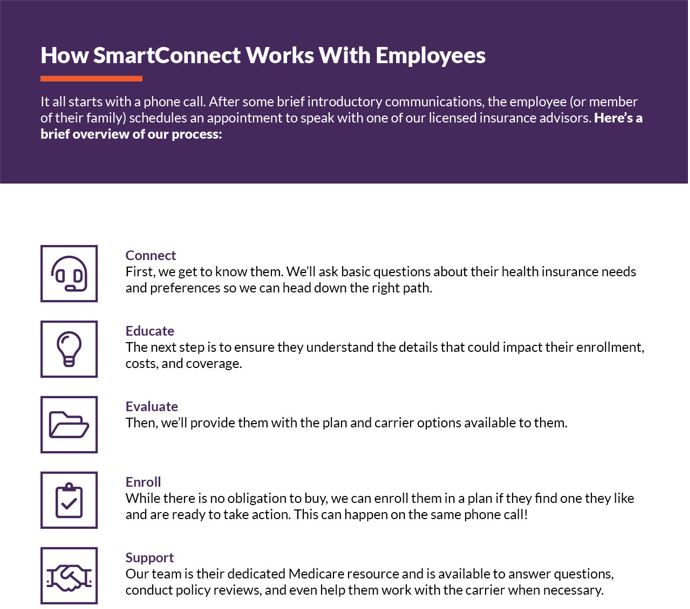

SmartConnect – A Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

Contact Information

Phone: 1-833-502-2747 TTY 711

For more information or to get started, please click on the following link: https://gps.smartmatch.com/

Additional Information